Imagine standing at the edge of a fast-moving financial world, where every decision holds the power to create wealth or lead to loss. For those drawn to the precision and psychology of options trading, one question rises to the top:

“How can I learn and refine my trading skills without putting real capital at risk?”

Options trading, with its intricate strategies involving calls, puts, strikes, and expirations, can feel like navigating a complex labyrinth. A misstep in the live market can lead to significant financial setbacks. This is precisely where a high-quality options trading simulator becomes your most valuable ally.

What Is an Option Trading Simulator?

Think of it as a flight simulator for an airline pilot. Would you prefer a pilot who has only read manuals or one who has spent countless hours in a simulator, experiencing every conceivable scenario, from routine takeoffs to emergency landings, all in a risk-free environment? The answer is obvious. The same principle applies to options trading.

An option trading simulator replicates real-market environments using virtual money, allowing traders to:

- Execute trades using real or delayed market data.

- Test strategies like Iron Condors, Butterfly Spreads, and Straddles.

- Understand Greeks like Delta, Gamma, Theta, and Vega in action.

- Experience market psychology without real-world consequences.

Think of it as your risk-free lab to fail, learn, adjust, and master.

For Beginners: Your Foundation for Success

For those just dipping their toes into the options market, simulators offer an unparalleled learning experience. Here’s how they lay a robust foundation:

- Risk-Free Exploration: This is the paramount advantage. You can experiment with various option strategies, from basic long calls and puts to more complex spreads like iron condors, butterflies, and straddles, without the constant fear of capital loss. This psychological freedom is crucial for learning and building confidence.

- Understanding Market Mechanics: Simulators provide a hands-on understanding of how option prices respond to changes in the underlying asset’s price, volatility (both implied and historical), time decay (also known as Theta), and interest rates. You’ll witness the “Greeks” – Delta, Gamma, Theta, Vega, and Rho – come alive, seeing their direct impact on your theoretical portfolio.

- Developing Trading Discipline: Emotions are the bane of successful trading. Simulators enable you to detach from the emotional rollercoaster of real money and focus solely on your analysis and strategy execution. You can practice adhering to your trading plan, setting stop-losses, and taking profits, cultivating the discipline essential for long-term success.

- Familiarity with Platform Interface: Every brokerage platform has its unique quirks. Simulators, which often mirror the live trading environment, allow you to become intimately familiar with order entry, charting tools, technical indicators, and risk management features, ensuring you’re not fumbling when real money is at stake.

- Testing Educational Concepts: Have you just finished a course on options strategies or read a book on technical analysis? A simulator is the ideal laboratory for testing these theoretical concepts in a practical setting. Do those candlestick patterns actually lead to profitable trades in a simulated environment? Now’s your chance to find out.

For Experienced Traders: Refining Your Edge

Even seasoned options traders benefit immensely from simulators:

- Strategy Backtesting and Forward Testing: Simulators with historical data enable you to backtest your strategies, running them against past market conditions to assess their performance. Forward testing involves testing a new strategy in real-time, albeit with virtual money, before deploying it live.

- Adapting to New Market Conditions: The market is a dynamic beast. Simulators provide a safe space to adjust your existing strategies or develop new ones in response to evolving market environments, such as periods of high volatility or significant economic shifts.

- Exploring Advanced Strategies: Options can be incredibly versatile, allowing for complex multi-leg strategies to hedge risk, generate income, or capitalize on specific market views. Simulators are ideal for experimenting with these intricate constructions, understanding their risk-reward profiles, and fine-tuning their parameters to optimize performance.

- Quantifying Risk and Reward: Before risking capital, experienced traders can use simulators to precisely quantify the maximum potential loss and profit of a strategy under various scenarios, aided by integrated risk analysis tools.

Key Features to Seek in a Top-Tier Options Trading Simulator

Not all simulators are created equal. To truly maximize your learning and practice, look for platforms that offer a robust set of features:

- Realistic Market Conditions (Real-time or Delayed Data): The gold standard is a simulator that uses real-time market data. This ensures your practice accurately reflects live market movements. Some simulators offer slightly delayed data, which can still be valuable for learning but may not be ideal for practicing ultra-short-term strategies, such as scalping.

- Technical Term: Tick-by-tick data offers the highest fidelity, replicating every single price change as it occurred in the live market, crucial for precise backtesting.

- Comprehensive Asset Coverage (Especially Options!): Ensure the simulator specifically supports options trading with a wide range of underlying assets (stocks, ETFs, indices) and various option contracts (calls, puts, different strike prices, and expiration dates). Some general stock simulators have limited options for functionality.

- Full Range of Order Types: A good simulator should allow you to practice with all order types you’d use in live trading:

- Market Orders: Execute at the best available price immediately.

- Limit Orders: Buy or sell at a specified price or better.

- Stop Orders (Stop-Loss and Stop-Limit): Essential for risk management, these orders trigger a market or limit order when a specific price is reached.

- Trailing Stops: A dynamic stop-loss that adjusts as the price moves in your favor.

- Multi-Leg Order Entry: Critically important for options, allowing you to enter complex strategies like spreads, straddles, and iron condors as a single order.

- Virtual Capital and Customizable Account Settings: The ability to set your initial virtual capital and reset it allows you to simulate various account sizes and practice capital management. Realistic commission structures and margin requirements are also a significant plus.

- Advanced Charting and Technical Analysis Tools: Professional-grade charting, equipped with a wide array of technical indicators (including Moving Averages, RSI, MACD, and Bollinger Bands), is indispensable for market analysis and strategy development.

- Options Chain and Analytics: A clear, interactive options chain displaying strike prices, expiration dates, bid/ask prices, volume, and open interest is fundamental. Integrated options analytics, including the “Greeks” (Delta, Gamma, Theta, Vega, and Rho), implied volatility, and probability analysis, are crucial for understanding option pricing and risk management.

- Strategy Builder and Risk Graphs: Many advanced simulators offer a “strategy builder” that enables you to construct complex option strategies and visualize their profit-and-loss (P&L) diagrams. These risk graphs are invaluable for understanding the maximum profit, maximum loss, break-even points, and overall risk profile of a position.

- Performance Tracking and Reporting: Detailed reports on your simulated trading performance, including profit and loss statements, win rates, average trade duration, and maximum drawdown, are essential for identifying strengths and weaknesses in your approach.

- Educational Resources and Community: Some simulators are part of broader educational platforms, offering tutorials, webinars, and even community forums where you can learn from and interact with other traders.

- Accessibility (Web-based vs. Desktop vs. Mobile): Consider whether you prefer a web-based platform accessible from any device, a robust desktop application, or a convenient mobile app for on-the-go practice.

The Contenders: Best Options Trading Simulators

Now, let’s delve into some of the top options trading simulators that consistently receive high praise from traders:

1. Charles Schwab thinkorswim (PaperMoney)

- Strategic edge: Widely regarded as one of the most powerful and comprehensive trading platforms available, thinkorswim’s “paperMoney” simulator offers a near-identical experience to its live trading counterpart. It provides $100,000 in virtual money (customizable), real-time market data, and access to an unparalleled suite of analytical tools, making it a dream playground for options enthusiasts. Its depth allows you to transition seamlessly from simulated practice to live trading with minimal adjustment.

- Specific Options Features:

- Option Chain Mastery: Provides an incredibly detailed options chain with customizable columns, allowing you to view open interest, volume, implied volatility, and all the “Greeks” (Delta, Gamma, Theta, Vega, Rho) at a glance for various strikes and expirations.

- Analyze Tab and Risk Graphs: This is where thinkorswim truly excels for options trading. The “Analyze” tab enables you to construct any multi-leg options strategy imaginable, ranging from simple calls and puts to complex iron condors, butterflies, and calendars. As you add legs, the platform dynamically generates a profit and loss (P&L) risk graph, showing potential outcomes at expiration and at various points in time. You can adjust implied volatility, time to expiration, and underlying price to see the hypothetical impact on your trade. This is invaluable for understanding the risk-reward profile of your strategies.

- Probability Analysis: Integrated tools help you visualize the probability of a stock reaching a certain price by expiration, aiding in strike selection.

- OptionStation Pro: A dedicated interface for advanced options analysis, scanning, and strategy development, offering even deeper insights.

- ThinkScript: For advanced users, the proprietary ThinkScript language allows you to create custom studies, scans, and even automated strategies, which can then be tested rigorously in paperMoney.

- Pros (Options-specific):

- Unrivaled Options Analytics: The “Analyze” tab and risk graphs are industry-leading for visualizing and understanding options strategies.

- Real-Time Data Accuracy: Crucial for realistic options price movements, especially for short-term strategies.

- Supports Every Strategy: From the most basic to the most exotic multi-leg combinations.

- Customization: A highly customizable interface, charts, and indicators cater to individual preferences.

- Integrated Education: Deep educational resources and a vast community support learning.

- Cons (Options-specific):

- Steep Learning Curve: The sheer volume of features can be overwhelming for absolute beginners, although it is powerful for those who invest time in learning it.

- Resource Intensive: The desktop platform can be demanding on older computers.

Ideal for: Beginners ready to dive into real-world options training, as well as experienced traders who demand precision and flexibility. Thinkorswim’s paperMoney simulator offers a beginner-friendly interface with guided tools, while also providing professional-grade analytics, multi-leg strategy support, and advanced features such as ThinkBack and thinkScript. Whether you’re just starting out or refining complex trades, it’s the perfect sandbox for mastering the options market, especially for those planning to go live with Schwab.

2. Interactive Brokers (Paper Trading)

- Strategic edge: Interactive Brokers (IBKR) is a top-tier choice for professional traders worldwide, renowned for its extensive market access, low commissions, and sophisticated trading tools. Its paper trading account is a direct mirror of its live Trader Workstation (TWS) platform, providing an authentic, high-fidelity simulation experience with real-time market data (if you have a live account with data subscriptions, otherwise delayed data). It’s designed to prepare you for the rigor of institutional-level trading.

- Specific Options Features:

- Depth of Options Chains: Offers extensive options chains with granular data, including implied volatility, Greeks, bid/ask spreads, and volume/open interest across numerous expiration cycles and strike prices.

- Option Strategy Builder: TWS allows you to construct complex multi-leg options strategies with ease. It automatically calculates the max profit, max loss, and break-even points, presenting them clearly.

- Options Analytics and Probability Lab: IBKR’s analytical tools, particularly the Probability Lab, are highly advanced. They enable you to analyze the probability of various outcomes for your option positions, stress-test strategies under different volatility scenarios, and gain a comprehensive understanding of the impact of the Greeks.

- Advanced Order Types: Practicing with a full spectrum of advanced order types, including bracket orders, conditional orders, and algorithmic order types, is crucial for options trading. These order types help automate risk management and identify key entry and exit points.

- Portfolio Management: The paper account accurately simulates margin requirements, portfolio profit and loss (P&L), and risk exposure, reflecting how options impact your overall portfolio health.

- Pros (Options-specific):

- Professional-Grade Realism: Closest experience to actual professional options trading, including realistic commission modeling (which is crucial for options profit analysis).

- Global Market Access: Simulate trading options on a vast array of underlying assets from numerous international exchanges.

- Advanced Risk Management: Robust tools for managing and understanding the intricate risks associated with complex options positions.

- Highly Customizable: TWS can be tailored to an extreme degree to fit your workflow.

- Cons (Options-specific):

- Very Steep Learning Curve: TWS is notoriously complex and can be daunting for beginners. It requires a significant time investment to master.

- Data Fees: To get real-time options data, you typically need to subscribe to market data packages, which usually require a funded live account.

- Less Beginner-Friendly Education: While powerful, the platform itself is less geared towards hand-holding beginners than some others.

Ideal for: Advanced and professional options traders, as well as ambitious learners who want to grow into institutional-grade tools. Interactive Brokers’ paper trading account mirrors its powerful live environment, making it perfect for testing high-volume, multi-leg strategies across global markets. With features like the Probability Lab, real-time data, and API integration, it’s especially valuable for those planning to go live with IBKR or develop automated, data-driven trading systems.

3. TradeStation (Simulated Trading)

- Strategic edge: TradeStation is a highly regarded platform for active traders, particularly those interested in systematic trading, backtesting, and automation. Its simulated trading environment is a robust replica of its live platform, offering real-time data and powerful analytical tools for options. TradeStation’s strength lies in its ability to help traders design, test, and automate their strategies.

- Specific Options Features:

- OptionStation Pro: This dedicated options analysis platform within TradeStation is a standout feature. It provides an intuitive, visual interface for building, analyzing, and executing multi-leg options strategies. You can view detailed risk graphs, profit and loss (P&L) statements at various price points, and implied volatility surfaces.

- Strategy Backtesting with EasyLanguage: A core strength. You can use TradeStation’s proprietary EasyLanguage programming language to code your own options strategies, indicators, and alerts, and then rigorously backtest them against historical data. This allows for scientific validation of your trading ideas before risking capital.

- Market Depth and Order Flow: Practice understanding market depth (Level 2 data) and order flow for options, as this can provide valuable insights into liquidity and potential price movements.

- Advanced Order Entry: Supports a wide range of conditional orders, OCO (One Cancels the Other) orders, and OTO (One Triggers Other) orders, which are essential for managing complex options positions automatically.

- Customizable Scanners: Build powerful options scanners to identify opportunities based on criteria like implied volatility rank, open interest changes, or specific options strategy setups.

- Pros (Options-specific):

- Exceptional Backtesting Capabilities: Best-in-class for quantitative analysis and validating options strategies against historical performance.

- Robust Options Strategy Building and Visualization: OptionStation Pro makes complex options understandable.

- Automation Potential: Allows users to simulate and prepare for automated options trading strategies.

- Unlimited Virtual Funds: Provides ample capital for extensive practice.

- Cons (Options-specific):

- Steep Learning Curve for Automation: While powerful, mastering EasyLanguage and the automation features requires a significant amount of dedication and effort.

- Requires a Funded Account: To access complete real-time data and all features, you typically need a funded live account.

- Interface Can Feel Dated: Compared to some newer, sleek platforms, the desktop interface might seem less modern to some users.

Ideal for: Experienced options traders, quantitative strategists, and technically inclined users who value advanced charting, automation, and strategy backtesting. TradeStation’s simulated trading environment is compelling for those exploring algorithmic options strategies or integrating technical indicators with multi-leg setups. It’s also a solid choice for intermediate traders looking to evolve into more sophisticated, data-driven decision-making.

4. TradingView (Paper Trading)

- Strategic edge: TradingView is renowned as a premier charting and social trading platform, beloved by technical analysts worldwide. While it’s not a full-fledged brokerage, its integrated paper trading feature provides an excellent, free, and web-based environment for practicing trading strategies on various assets, including options, with real-time market data. Its strength lies in its intuitive charting and community-driven insights.

- Specific Options Features:

- Seamless Charting Integration: You can place paper trades directly from the charts, applying your technical analysis (using a vast library of indicators and drawing tools) to your simulated options entries and exits.

- Direct Order Entry for Options: TradingView allows you to select options contracts and place market, limit, and stop orders in a simulated environment, replicating the basic functionality of a brokerage.

- Performance Tracking: Automatically logs your simulated trades, enabling you to review your profit/loss, win rate, and other key metrics to assess the effectiveness of your strategy.

- Community-Driven Learning: Access to a huge community of traders sharing ideas, analyses, and strategies, which can be invaluable for learning about different option approaches. You can even follow others’ paper trading performance.

- Alerts System: Set custom price alerts on the underlying assets to notify you of potential trading opportunities in options.

- Pros (Options-specific):

- Best-in-Class Charting: Unparalleled flexibility and tools for technical analysis, directly integrated with paper trading.

- Free and Web-Based: Highly accessible from any device with an internet connection, without requiring an account with a specific broker.

- Real-Time Data (Free): Essential for accurately simulating option price movements.

- Social Trading Element: Learn from and interact with a vast community of traders, including those focused on options.

- Cons (Options-specific):

- No Dedicated Options Chain: While you can trade options, TradingView does not offer the same deep, interactive options chains with detailed Greeks or advanced risk graphs that broker-specific platforms provide. It’s more about executing basic options trades based on in-depth analysis of the underlying asset.

- Limited Multi-Leg Strategy Builder: Building and visualizing complex multi-leg options strategies can be challenging within the paper trading interface.

- Not a Brokerage: You cannot seamlessly transition from paper trading to live options trading on the same platform. To trade live, you’ll need to connect to a supported broker. While you can use custom scripts, built-in strategies, or overlays like OnePunch Algo to assist with entry timing, TradingView does not support complete options analytics such as Greeks or multi-leg trade modeling.

Ideal for: Visual learners, beginner-to-intermediate traders, and technical analysts who want to integrate real-time charting with hands-on practice. While TradingView’s paper trading doesn’t natively support complex options, it’s excellent for testing directional strategies, analyzing market structure, and syncing signals with broker-connected platforms. Its intuitive interface, massive community, and scriptable indicators make it a favorite starting point for those learning to trade with charts at the core.

5. NinjaTrader (Trading Simulation)

- Strategic edge: NinjaTrader is renowned for its advanced charting, market analysis, and automated trading capabilities, particularly strong in futures and forex. However, it also offers powerful options and simulation functionalities. Its highly customizable desktop platform appeals to traders who want to delve deep into technical analysis and strategy optimization.

- Specific Options Features:

- Robust Charting for Underlying Assets: While options themselves don’t have charts in the same way stocks do, NinjaTrader’s exceptional charting capabilities for the underlying assets are crucial for technical analysis that informs your options trades. You can apply a vast array of indicators and drawing tools.

- Strategy Builder and Backtesting: You can build and backtest options strategies using NinjaTrader’s powerful backtesting engine. While it may require a bit more manual setup for complex option strategies compared to dedicated option analysis tools, its flexibility allows for in-depth quantitative analysis.

- Custom Indicators and Add-ons: The platform supports a huge ecosystem of third-party add-ons and allows users to develop their own custom indicators and strategies using its C#-based programming environment, which can then be applied to options analysis.

- Replay Feature: Simulate historical market data tick-by-tick, allowing you to re-experience past market conditions and test how your options strategies would have performed in those exact moments. This is invaluable for learning from specific historical events.

- Advanced Order Management: Practice with a full suite of order types and order flow visualization, which is particularly relevant for options where precise entry and exit can significantly impact profitability.

- Pros (Options-specific):

- Exceptional for Technical Analysis: Best-in-class charting and indicator capabilities for analyzing the underlying asset.

- Powerful Backtesting and Replay: Ideal for data-driven options traders who want to test hypotheses rigorously.

- High Customization: The platform can be extensively tailored to suit individual trading styles and analysis needs for options.

- Community and Add-ons: A large community and marketplace for additional tools can enhance options analysis.

- Cons (Options-specific):

- Less Native Options-Specific Tools: While powerful for analysis, it’s not as natively geared towards options chain analysis and risk graphs as thinkorswim or TradeStation. You might need custom solutions or external tools for certain options-specific visualizations.

- Desktop-Centric: Primarily a desktop application, with less emphasis on web or mobile functionality.

- Can Incur Data Fees: To access real-time data, you often need to subscribe to data feeds, which can incur additional costs.

Ideal for: Experienced traders who want deep technical analysis and quantitative backtesting for their options strategies, those interested in developing and automating their own trading systems, and futures traders looking to expand into options with a familiar platform.

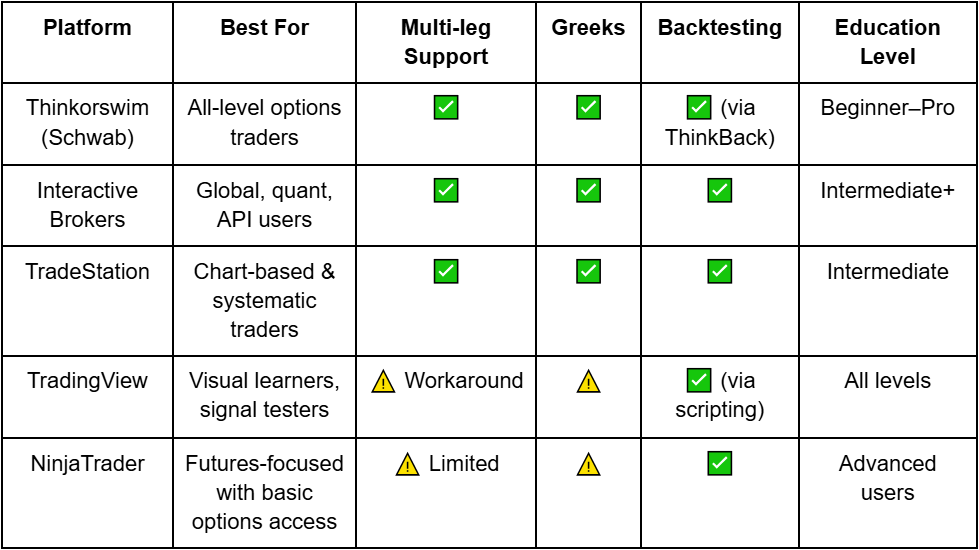

– Top Option Trading Simulators (2025) – Summary Table

Making the Most of Your Options Trading Simulation

Simply logging into a simulator isn’t enough. To truly accelerate your learning and prepare for live trading, adopt these proactive habits:

- Set Clear Goals: Before you even place your first virtual trade, define what you want to achieve. Are you looking to understand the basics of option mechanics? Test a specific strategy? Improve your risk management? Having clear objectives will guide your practice.

- Treat It Like Real Money: This is paramount. Resist the urge to make reckless, “YOLO” trades just because it’s virtual money. Practice the same due diligence, risk assessment, and emotional control you would with real capital.

- Document Everything (Trading Journal): Keep a detailed trading journal for your simulated trades. Record the date, time, underlying asset, strategy used, entry and exit points, reasons for the trade, and the outcome. This reflective practice is invaluable for identifying patterns in your decision-making and refining your approach to problem-solving.

- Analyze Your Performance: Regularly review your simulated performance reports to assess your progress. What strategies are working? Which ones are consistently losing? Are you adhering to your risk parameters? Use this data to iterate and refine your approach.

- Focus on Risk Management First: Before chasing profits, prioritize risk management. Practice setting appropriate stop-losses, understanding your maximum potential loss on each trade, and managing your position sizing.

- Example for beginners: Start with simple strategies, such as buying single calls or puts, and focus on understanding the profit and loss (P&L) profiles before moving on to more complex spreads.

- Experiment and Iterate: Don’t be afraid to try different strategies and adjust your approach. The simulator is your safe space for experimentation and exploration. Learn from your mistakes and refine your winning methods.

- Stay Updated with Market News: Even in a simulated environment, staying abreast of real-world economic news, company earnings, and geopolitical events will help you understand their impact on market sentiment and asset prices.

- Don’t Rush to Live Trading: Only transition to live trading when you consistently demonstrate profitability and discipline in your simulated environment. There’s no magical timeline; it depends on your individual learning curve.

Bridging the Gap: From Simulated to Live Trading

Simulators are the gym. The real market is the ring. Train with intention. Enter with discipline.

You’re ready when:

- You’ve logged 100+ paper trades with strategy-specific consistency

- You understand how each Greek affects your position

- You no longer trade emotionally

- Your win/loss ratio and risk/reward align with your goals

Start by mirroring your simulated account size in live markets.

Pro Tips for Simulator Success

- Set Realistic Capital: Simulate $5K or $10K, not $1M, for authenticity

- Log Every Trade: Include setup, thesis, Greek values, and emotion level

- Master One Strategy at a Time: Isolate variables and measure performance

- Use Backtesting: Analyze how your strategy handled past volatility (e.g., COVID crash)

- Review with Risk Graphs: Make sure every trade is intentional, not random

Final Thoughts: Simulators Are Not Games, They’re Launchpads

Options trading is more than just numbers; it’s a discipline, a science, and a mindset. The most successful traders didn’t rely on luck; they relied on preparation. Simulators provide a safe space to make mistakes, refine strategies, and build confidence, without putting real capital at risk.

Whether the goal is to create a reliable side income or manage a professional trading portfolio, mastering the fundamentals in a risk-free environment is the first step toward success. In trading, practice doesn’t just make perfect; it helps prevent disaster.

So choose a high-quality options trading simulator, set your first trade, and begin building the habits of a disciplined, confident trader, without risking a dime.

Ready to Take the First Step? Join the OnePunch ALGO Academy

Looking to go beyond simulations and start trading with precision? The OnePunch ALGO Academy is more than a platform; it’s a growing community of traders using proprietary tools, real-time strategies, and data-driven insights to navigate the options market. Learn how to time entries, manage risk, and trade smarter with our proven ALGO-powered setups.

Learn on the Go with Our YouTube Channel

Prefer visual learning? Subscribe to the OnePunch ALGO YouTube Channel for free trading tutorials, simulator walkthroughs, and expert insights. Whether a beginner or an advanced trader, the channel offers powerful lessons that help turn theory into practice fast.

Start your trading journey today with the right simulator, supported by the OnePunch ALGO community and resources.

Train. Learn. Execute – with confidence.