Trading is far more than a mechanical exercise of buying low and selling high. It is a dynamic fusion of art, science, and psychology. Every tick of the market tells a story, a narrative driven by countless factors: the ebb and flow of supply and demand, geopolitical tensions, central bank announcements, corporate earnings, and even the collective emotions of millions of traders worldwide. To trade successfully, one must learn to read these signals, anticipate the market’s next moves, and act with precision and confidence.

Think of the markets as a living organism: it breathes, reacts, and adapts. Price movements are not random; they reflect the invisible tug-of-war between buyers and sellers, fear and greed, patience and impulse. Each chart pattern, candlestick formation, or breakout is a snapshot of this battle, offering clues to those trained to see them.

In this complex ecosystem, binary options stand out as an elegant and disciplined way to engage. Unlike traditional stock or forex trading, which often requires in-depth knowledge of position sizing, margin, or derivative Greeks, binary options distill trading down to a simple yet powerful question: Will the price go up or down in a defined time frame?

Yet simplicity should not be mistaken for ease. Profitable binary option trading requires strategic thinking, risk awareness, and emotional control. It is about turning observation into insight, and insight into action. Traders must learn to interpret volatility, market momentum, and technical signals, transforming what may seem like chaos into a structured decision-making process.

For beginners, binary options are not just a financial instrument; they are a training ground for understanding the market’s heartbeat. They offer the opportunity to witness the cause-and-effect of market forces in real time, allowing new traders to develop a sense of timing, risk management, and disciplined execution.

By approaching trading as both an art and a science, binary option traders can cultivate intuition backed by analysis, transforming raw market data into actionable insights. This introduction is just the beginning. Once you grasp the mechanics and mindset, the possibilities for learning, growth, and profit expand exponentially.

Understanding Binary Options: The Basics

Binary options are a unique type of financial derivative that allows traders to speculate on whether the price of an asset will rise or fall within a specific timeframe. Unlike traditional trading, where profits and losses fluctuate with the magnitude of price movement, binary options offer a fixed, predetermined payout or total loss. This simplicity makes them particularly appealing for beginners, yet mastering them requires an understanding of both market mechanics and disciplined strategy.

At their core, binary options revolve around directional predictions:

- Call Option: The trader predicts that the asset’s price will rise above a certain level (the strike price) by the expiry time.

- Put Option: The trader predicts that the asset’s price will fall below the strike price by the expiry time.

How a Trade Works

Imagine the stock of Tesla is trading at $700. You anticipate that it will rise to $710 within the next 30 minutes. By purchasing a call option:

- If Tesla reaches or exceeds $710 at expiry → You earn a fixed profit (e.g., 80% of your investment).

- If Tesla fails to reach $710 → You lose your invested amount.

Binary options are all-or-nothing bets, which turn trading into a highly disciplined exercise in timing, prediction, and risk management. Unlike traditional options, you don’t need to worry about delta, theta, or other complex “Greeks”; your focus is entirely on the accuracy of your directional call.

The Simplicity and Power of Binary Options

Binary options are often misunderstood. Their straightforward payout structure masks the depth of skill required to trade profitably. While the question seems simple: will the price go up or down?, profitable trading demands the ability to:

- Analyze Market Trends: Understanding whether the market is in a bullish, bearish, or sideways phase.

- Interpret Technical Indicators: Using RSI, Bollinger Bands, or moving averages to gauge potential reversals or continuations.

- Time Entries Precisely: Correct predictions at the wrong time result in losses, emphasizing the importance of expiry selection.

- Manage Risk Strategically: Avoid overexposure, set sensible trade sizes, and maintain a disciplined approach.

Example Scenario

Let’s break it down with a practical example:

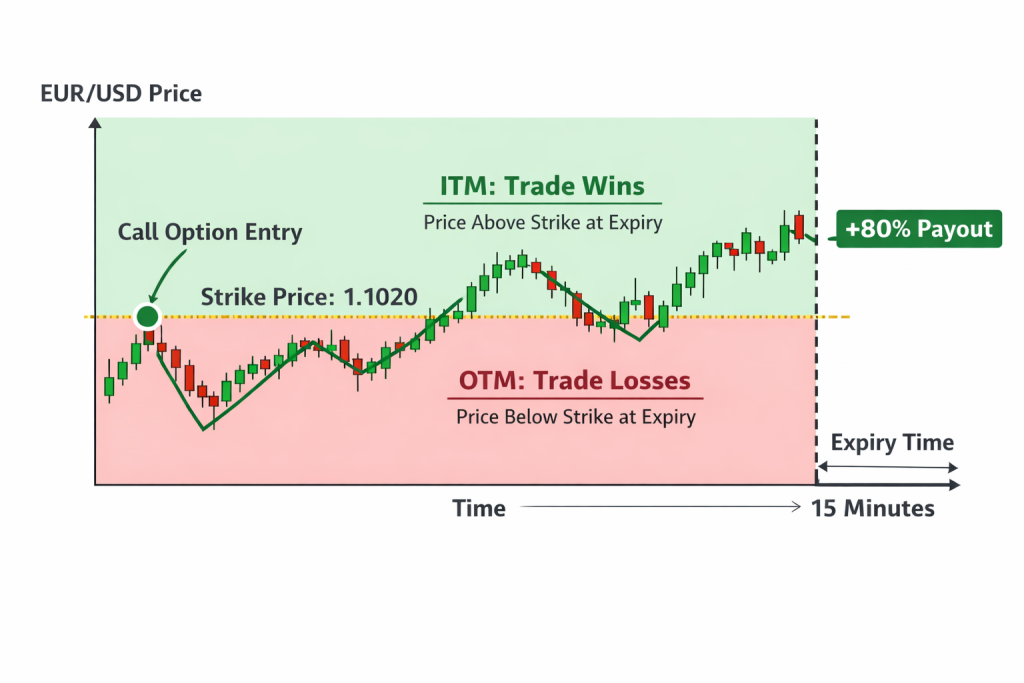

- Asset: EUR/USD

- Current Price: 1.1000

- Prediction: Price will rise to 1.1020 in 15 minutes

- Option Type: Call

- Investment: $100

- Payout: 80%

Outcome:

- Correct prediction: $100 stake + $80 profit = $180 total

- Incorrect prediction: Loss limited to $100 stake

This fixed-risk framework allows beginners to understand both the potential reward and potential loss upfront, a rare clarity in financial markets.

Why Binary Options Appeal to Traders

- Clarity: With predefined risk and reward, you always know the stakes.

- Speed: Short expiries allow traders to capitalize on rapid market movements.

- Accessibility: Binary options allow trading across multiple assets, stocks, forex, commodities, and indices from a single platform.

- Skill Development: Beginners can learn price action, technical analysis, and market behavior in a controlled environment.

Binary options are not a shortcut to easy money; they are a learning laboratory for disciplined traders. Each trade teaches observation, prediction, and risk management. By understanding how price reacts to market forces and how timing and strategy intersect, traders can transform the binary question of “up or down” into an opportunity for structured growth and skill development.

Key Components of Binary Options

Understanding the key components of binary options is essential for anyone serious about trading. Each element plays a critical role in determining how trades are executed, how risk is managed, and how profit is achieved. Let’s break them down one by one.

1. Underlying Asset

The underlying asset is the financial instrument whose price movement determines the outcome of your binary option trade. It could be a stock, a currency pair, a commodity, or a market index.

Examples:

- Stocks: Apple, Tesla, Amazon

- Forex Pairs: EUR/USD, GBP/JPY

- Commodities: Gold, Silver, Oil

- Indices: S&P 500, NASDAQ

Why it matters: Each asset behaves differently. Forex pairs are highly sensitive to economic indicators, stocks react to corporate news, and commodities respond to supply-demand shifts. Understanding the unique characteristics of your chosen asset is vital to accurately predicting price movement.

2. Strike Price

The strike price is the level that the asset must reach for your trade to be profitable. It is the benchmark against which your prediction is measured.

- Call Option: Price must rise above the strike price.

- Put Option: Price must fall below the strike price.

Example:

- Asset: EUR/USD

- Current price: 1.1000

- Strike price for call option: 1.1020

- Outcome: Price at expiry ≥ 1.1020 → ITM (In-the-Money) → profit

Strategic Insight:

- Near-the-Money (NTM): Safer, higher probability of success, but lower payout.

- Out-of-the-Money (OTM): Riskier, lower probability, higher payout if correct.

3. Expiry Time

Binary options are time-sensitive, meaning the trade outcome is determined at a specific moment, the expiry time.

Common expiry ranges:

- Short-term: 1–30 minutes – ideal for intraday momentum trades.

- Medium-term: 1–24 hours – suitable for trend-following or reversal trades.

- Long-term: Days to months – often aligned with major economic or corporate events.

Choosing the right expiry is critical. A well-predicted market move can fail if the expiry is mistimed. Short expiries capture rapid movements but are susceptible to noise; long expiries give trends more time but require patience and observation.

4. Payout and Loss

Binary options are known for fixed payouts and fixed losses, making risk management straightforward:

- Payout: A pre-defined percentage of your investment if correct (e.g., 70–90%).

- Loss: Limited to the investment amount if incorrect.

Example:

- Investment: $100

- Payout: 80% → Profit = $80 if correct

- Loss: $100 if wrong

Strategic Tip: This fixed structure allows traders to plan trades precisely, calculate expected value, and implement disciplined risk management without worrying about fluctuating outcomes.

5. Investment Amount

The investment amount is the amount of capital you allocate per trade. Effective money management is essential to protect your portfolio.

Best Practices:

- Risk only 2–5% of total trading capital per trade.

- Adjust trade size according to market conditions, confidence, and strategy.

Treat your trading capital like fuel. Every trade should be purposeful, calculated, and disciplined, not based on emotion or guesswork.

6. Option Status: ITM, ATM, OTM

Binary options are classified according to how the current price relates to the strike price:

- In-the-Money (ITM): Price favors your prediction; profit likely.

- At-the-Money (ATM): Price equals strike; a small movement decides the outcome.

- Out-of-the-Money (OTM): Price is against your prediction; high risk but high reward if correct.

Why These Components Matter

Mastering these components allows traders to:

- Analyze the right assets – Understanding asset behavior improves prediction accuracy.

- Set optimal strike prices and expiries – Maximizes probability of success while controlling risk.

- Manage capital effectively – Fixed risk and payout allow clear money management strategies.

- Interpret outcomes with clarity – ITM, ATM, and OTM classifications provide immediate insight.

Binary options simplify trading without simplifying skill. By mastering assets, timing, strike, and capital management, a trader transforms raw opportunity into structured, high-probability decisions.

How Binary Options Work: Step-by-Step

Binary options are simple in structure but sophisticated in practice. Understanding how a trade is executed, evaluated, and settled is essential for any trader aiming to succeed.

Step 1: Choosing the Asset

The first step is selecting the underlying asset for your trade. This could be a stock, a forex pair, a commodity, or an index. Each asset has unique characteristics:

- Stocks: React to company earnings, news, and industry trends.

- Forex: Highly liquid, reacts quickly to economic indicators and geopolitical events.

- Commodities: Influenced by supply-demand shifts, geopolitical events, and natural disasters.

- Indices: Reflect overall market sentiment, less volatile than individual stocks but responsive to macroeconomic trends.

Example: You choose EUR/USD because you expect high volatility after an economic announcement.

Step 2: Selecting a Call or Put Option

Next, decide whether the asset will rise (Call) or fall (Put) by the time your chosen expiry time arrives.

- Call Option: Buy if you predict the price will increase.

- Put Option: Buy if you predict the price will decrease.

Example: EUR/USD is at 1.1000. You anticipate a rise to 1.1020 within 15 minutes → purchase a Call option.

This is the moment of conviction. Accurate market reading and confidence in your analysis make the difference between a winning and losing trade.

Step 3: Setting the Strike Price and Expiry

The strike price and expiry time define the trade’s terms:

- Strike Price: The reference level at which the price must surpass for a Call or fall below for a Put.

- Expiry Time: When the option ends, and the outcome is determined.

Example:

- Strike Price: 1.1020

- Expiry: 15 minutes

If the price reaches 1.1020 or higher at expiry → ITM → fixed profit.

If not → OTM → total loss of the invested amount.

Step 4: Investment Amount and Payout

Decide how much capital to risk on the trade. Binary options have fixed payouts, so risk is predefined.

- Investment: $100

- Payout: 80% → Profit $80 if correct

- Loss: $100 if wrong

Strategic Tip: Only risk 2–5% of total capital per trade to maintain longevity in the market.

Step 5: Monitoring the Trade

Once the trade is placed, watch price action carefully. While binary options are short-term, market context matters:

- Observe support and resistance levels.

- Monitor key technical indicators such as RSI, Moving Averages, and Bollinger Bands.

- Note market events that may affect volatility.

Example: If EUR/USD spikes unexpectedly due to news, you may notice the price hovering near the strike price. This is a moment to observe market psychology, not a chance to intervene; the outcome is predetermined.

Step 6: Trade Expiry and Outcome

At expiry, the option is evaluated:

- In-the-Money (ITM): Trade prediction correct → receive payout.

- Out-of-the-Money (OTM): Trade prediction incorrect → lose investment.

- At-the-Money (ATM): Price equals strike → some brokers return a partial amount.

Step 7: Learning from Results

Binary options trading is iterative. Each trade provides lessons:

- Did your analysis correctly predict the market direction?

- Did you choose an appropriate expiry?

- Was the strike price optimal?

- How did external factors (news, volatility, market sentiment) affect the outcome?

Keeping a trading journal is essential for improving accuracy, discipline, and risk management.

Binary options are deceptively simple: a single yes-or-no prediction can generate immediate feedback about your market understanding. Each trade is a lesson in timing, analysis, and psychology. Success comes from observing patterns, learning from mistakes, and continually refining strategy.

Why Binary Options Are Popular

Binary options have surged in popularity because they simplify trading without compromising skill or strategy. Unlike traditional markets, where profits and losses fluctuate with market magnitude, binary options provide clarity, speed, and accessibility.

Key reasons for popularity:

- Simplicity: Traders only need to predict direction, up or down, removing the complexity of calculating profit per price movement.

- Fixed Risk and Reward: Every trade has a predefined loss and payout, making money management straightforward.

- Short-Term Opportunities: Expiries range from 60 seconds to several hours, allowing traders to profit from rapid market movements.

- Wide Asset Access: Stocks, commodities, currencies, and indices can all be traded on one platform.

- Skill Development: Beginners learn market psychology, price action, and technical analysis in a structured environment.

Binary options transform trading from guessing into a discipline-driven craft. They let traders experience real market dynamics and understand price behavior in a concise, risk-defined format.

The Mechanics Behind Price Movements

To profit in binary options, it is essential to understand why prices move. Markets are driven by supply and demand, sentiment, news, and technical signals.

1. Supply and Demand:

- When buyers outnumber sellers, prices rise → bullish pressure.

- When sellers dominate, prices fall → bearish pressure.

2. Economic and Geopolitical Factors:

- Currency pairs react instantly to interest rate decisions, CPI, or employment reports.

- Stocks respond to earnings reports, mergers, or regulatory changes.

- Commodities react to supply disruptions, weather events, or global demand.

3. Technical Factors:

- Price respects support and resistance zones, reacts to trendlines, moving averages, and oscillators.

- Breakouts and reversals often occur near key technical levels, influencing momentum.

Every price movement is a story of competing forces. Traders who understand these forces can anticipate short-term directional shifts, perfect for binary options.

How Traders Make a Profit

Profit in binary options is achieved by accurately predicting the price direction within a set expiry period. Unlike traditional trading, magnitude does not matter; timing and direction are key.

Step-by-Step Mechanics:

- Analyze Market Conditions: Identify trends, volatility, and key technical levels.

- Select Asset and Option Type: Call if expecting a rise; Put if expecting a fall.

- Set Strike Price and Expiry: Align strike price with realistic price targets and expiry with market behavior.

- Risk Management: Invest an amount that balances potential reward and capital protection.

- Outcome: If the prediction is correct (ITM), earn a fixed payout; if incorrect (OTM), accept a fixed loss.

Example:

- Asset: Gold

- Current price: $1,900

- Prediction: Price will rise to $1,905 in 30 minutes → Call option

- Investment: $100, Payout: 80%

- Result: Price at expiry $1,906 → Profit $80

Profit is not luck. It’s strategy, timing, and discipline combined with a deep understanding of market behavior. Binary options reward precision over guesswork.

To see how these principles play out in real markets, the OnePunch Algo Scalper and Golden Lines provide live support/resistance insights for SPY & QQQ 0DTE trades, demonstrating how high-probability setups are identified and executed.

Risk Management in Binary Options

Risk management is the cornerstone of sustainable trading. Even with fixed losses, poor capital control can wipe out accounts quickly.

Key Principles:

- Limit Investment per Trade: Risk 2–5% of total capital on a single trade.

- Diversify Trades: Avoid overconcentration on a single asset or strategy.

- Choose Appropriate Expiry: Longer expiries reduce noise; shorter expiries exploit volatility.

- Stack Confirmations: Combine indicators, support/resistance, and price action to avoid low-probability trades.

- Trading Journal: Record trades, rationale, and outcomes to refine strategy.

Binary options teach discipline like no other instrument. Fixed-loss trades encourage careful analysis, patience, and strategy refinement, key traits for long-term success.

Conclusion: Mastering Binary Option Trading

Binary option trading remains one of the most exciting and accessible ways to engage with financial markets, offering both flexibility and opportunity for traders who approach it with discipline, strategy, and technical insight. From predicting price movements in high-liquidity assets such as EUR/USD, Gold, or major stocks to leveraging tools such as RSI, Bollinger Bands, and candlestick patterns, successful traders understand that preparation and analysis are just as important as timing.

Understanding strike prices, expiry times, market volatility, and price action can transform simple predictions into calculated trades with higher probability outcomes. Combining technical indicators with structured strategies helps traders manage risk, identify optimal entry points, and maximize short-term opportunities in dynamic markets. Consistently reviewing trades, journaling outcomes, and refining approaches cultivates the skills and intuition required for long-term success.

For traders looking to elevate their game, OnePunch ALGO Academy offers a community-driven platform to explore Smart Zones, develop strategies, and apply them to real-world markets. Complementing this, the OnePunch ALGO YouTube channel offers tutorials, live trade breakdowns, and practical insights to help traders understand market behavior and strengthen decision-making. These resources serve as supportive tools that can guide growth, refine strategy execution, and enhance confidence, without replacing the discipline and analysis that ultimately drive success.

Binary option trading is a journey that combines knowledge, observation, and execution. By integrating educational insights with disciplined practice, traders can approach markets with clarity, precision, and confidence, turning every trade into an opportunity to learn, adapt, and thrive.