In the ever-evolving landscape of global finance, trading has transformed from a specialist’s domain into an accessible and dynamic pursuit for anyone with an internet connection and a curiosity for markets. From seasoned professionals on Wall Street to individual retail traders worldwide, the art and science of trading have become increasingly democratized. It’s no longer just about buying and holding stocks; trading today is about timing, strategy, analysis, and adaptability.

Investing in the trading field offers more than just financial returns. It cultivates critical thinking, emotional discipline, and decision-making under pressure. As individuals begin their journey into this space, they often start with traditional assets, such as equities or mutual funds. However, as their understanding matures and the desire for more sophisticated tools grows, many naturally gravitate toward the world of derivatives. Among these, options trading stands out, not just for its profit potential but for the level of control and flexibility it provides.

This article delves beyond definitions to explore the fundamental mechanics of option trading from the ground up. Whether you’re stepping into derivatives for the first time or looking to refine your understanding, this is a passionate, practical, and technically rich guide to help you take full advantage of one of the market’s most flexible instruments.

Understanding the Foundation: How Option Trading is Structured

Option trading is not just about predicting where a stock might go; it’s about positioning yourself with defined risk and tailored exposure. At its foundation, option trading revolves around the idea of conditional contracts. These contracts grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time period. This principle introduces an entirely different layer of strategy compared to traditional stock trading.

Unlike stocks, which represent ownership, options represent potential; they give traders a strategic edge to bet on price movements, manage risk, or generate income. However, to fully appreciate this power, one must understand how these contracts are structured and the variables that affect them.

Each option contract is built on the following essential elements:

- Underlying Asset: The financial product the option is based on, such as a stock, ETF, index, or commodity.

- Strike Price: The set price at which the asset can be bought (call) or sold (put).

- Expiration Date: The date after which the option ceases to exist.

- Option Type: Call or Put, indicating the direction of the anticipated trade.

- Premium: The cost paid by the buyer to the seller for acquiring the contract.

Behind these structural components lie four critical forces that shape every option trade:

- Direction – Will the asset rise or fall?

- Magnitude – By how much might the price move?

- Timeframe – How long until the option expires?

- Volatility – How much uncertainty or fluctuation exists in the asset’s movement?

These forces determine the value of an option and its behavior under changing market conditions. Traders who understand how direction, magnitude, timing, and volatility interact can structure positions that precisely align with their market outlook, whether bullish, bearish, or neutral.

One of the most significant advantages of this framework is the risk-to-reward customization. A trader can cap potential losses by only risking the premium paid while gaining exposure to much larger moves in the underlying asset. This makes options not only powerful for speculation but also practical for hedging and income generation.

Understanding this structural framework is the key to unlocking the true potential of option trading; it’s where calculated opportunity meets defined risk in a strategic setting.

The Players: Call and Put Options

Every option strategy lies on two fundamental instruments: call options and put options. These are the building blocks of every trade in the options market. To understand how options work, it’s crucial to distinguish these roles and how they align with different market expectations.

Call Options are contracts that give the buyer the right (but not the obligation) to buy the underlying asset at a predetermined strike price before the expiration date. Traders typically buy call options when they believe the asset’s price will rise. The goal is to benefit from a price increase without owning the asset outright.

Put Options, on the other hand, give the buyer the right to sell the underlying asset at a specified strike price before the option expires. Puts are commonly used when a trader expects the price of the asset to fall. Buying a put option allows them to profit from a decline in value or to hedge an existing position against downside risk.

You can either buy or sell (write) these options, resulting in four basic positions:

- Buy Call

- Sell Call

- Buy Put

- Sell Put

Each position reflects a unique strategy, risk profile, and market expectation.

Buying a Call Option: Gaining with Bullish Momentum

You pay a premium for the right to buy the asset at a set price. If the asset rises above the strike price plus the premium, you profit. Loss is limited to the premium, while the upside is unlimited—ideal for bullish outlooks.

Selling a Call Option: Betting Against a Rally

You collect a premium, hoping the asset stays below the strike price. If it rises sharply, losses can be unlimited (especially in naked calls). It’s a high-risk strategy suited for experienced traders.

Buying a Put Option: Capitalizing on the Downside

You gain if the asset falls below the strike price. This is a go-to strategy during bearish trends or to hedge long positions. Loss is capped at the premium paid; potential gains grow as prices drop.

Selling a Put Option: Getting Paid to Be Bullish

You earn a premium in exchange for the obligation to buy the asset if its price falls below the strike price. If the asset stays above, you keep the premium. Many use this to purchase stocks at a discount with built-in income.

This interplay between buyers and sellers creates a dynamic environment in which strategies can be developed around market direction, volatility, and time. Understanding the roles of calls and puts, and how traders position themselves on either side of the contract, is key to mastering the options market.

Option Payoff Diagrams: Seeing the Strategy

A payoff diagram is a visual tool that maps out potential profit or loss at expiration based on the underlying asset’s price. By plotting stock price on the horizontal axis and profit or loss on the vertical axis, traders can clearly see a strategy’s break-even point, risk, and reward potential. These diagrams simplify complex strategies, making it easier to plan trades and manage risk effectively.

For example:

- Buying a Call Option: The payoff diagram starts below zero (due to the premium paid) and slopes upward after the strike price, showing unlimited profit potential as the underlying asset price rises.

- Buying a Put Option: The graph begins below zero but slopes upward as the underlying price falls below the strike price, reflecting the profit potential in declining markets.

- Selling a Call or Put: The shapes are inverted compared to buying, capping the maximum profit at the premium received but exposing the trader to potentially significant losses if the underlying moves significantly against their position.

Real-World Illustration: The Option Chain in Motion

To understand how options work in real trading conditions, it’s essential to observe an option chain, a live snapshot of all available options for a specific asset, like a stock or ETF. This chain displays multiple strike prices and expiration dates, enabling traders to assess the cost, probability, and payoff potential.

Example 01: Imagine stock XYZ is trading at $50.

You buy a call option with:

- Strike price: $55

- Expiration: 30 days

- Premium: $2

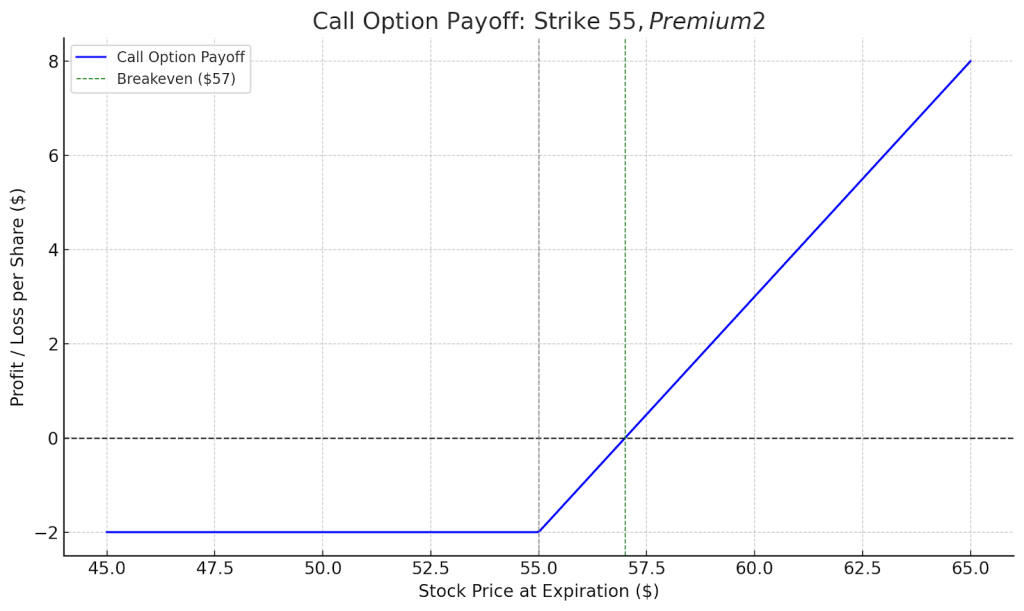

Here is the payoff diagram for buying a call option on stock XYZ:

- Strike Price: $55

- Premium Paid: $2

- Breakeven Point: $57 (green dashed line)

How to Read the Graph:

- If the stock stays below $55, the call expires worthless → loss = -$2 per share

- Between $55 and $57, the loss decreases, but the trade is still negative

- Beyond $57, the trade becomes profitable, and gains increase as the stock price rises

This scenario clearly shows how options create defined-risk opportunities that allow traders to speculate on price movements with minimal capital exposure.

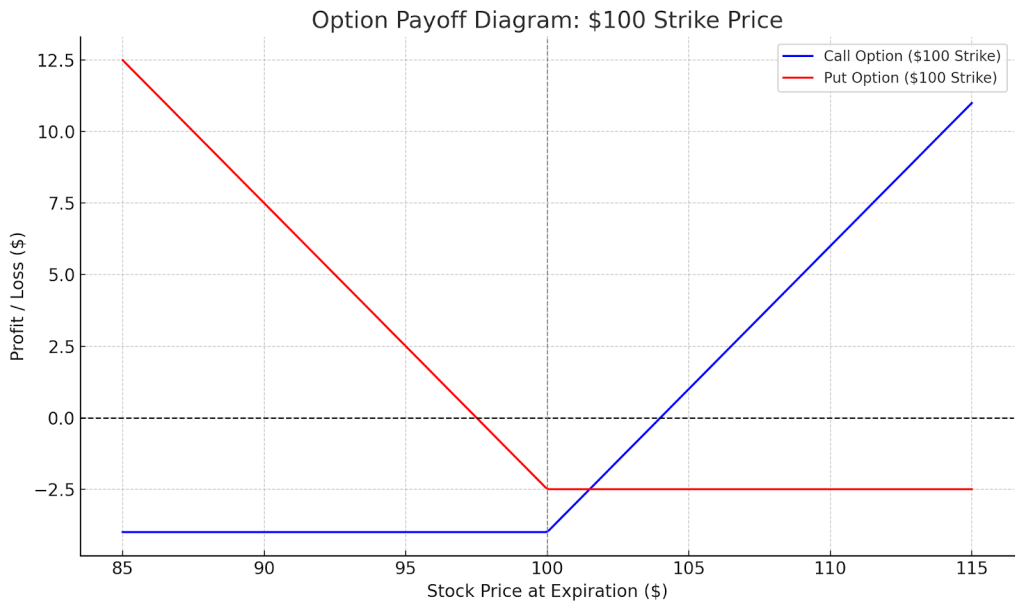

Example 02: Imagine a stock currently trading at $100. You open the option chain and see:

| Strike Price | Call Premium | Put Premium |

| $95 | $6.50 | $1.20 |

| $100 | $4.00 | $2.50 |

| $105 | $2.10 | $5.00 |

From this data:

Call Option at $100 Strike, $4.00 Premium

- Breakeven = $100 (strike) + $4.00 (premium) = $104

- If the stock finishes below $100, the option expires worthless → loss = -$4

- If the stock finishes above $104, the call is profitable → profit = stock price – 100 – 4

On the graph:

- The blue line stays at -4 until the stock price hits $100

- Then it slopes upward

- It crosses the $0 line exactly at $104 (breakeven)

Put Option at $100 Strike, $2.50 Premium

- Breakeven = $100 – $2.50 = $97.50

- If the stock finishes above $100, the option expires worthless → loss = -$2.50

- If the stock finishes below $97.50, it becomes profitable → profit = 100 – stock price – 2.50

On the graph:

- The red line stays at -2.50 until the stock price drops to $100

- Then it slopes upward (profit increasing as price falls)

- It crosses the $0 line exactly at $97.50 (breakeven)

This chain helps traders decide:

- Which direction do they expect the asset to move

- How far the asset might move (magnitude)

- How much they’re willing to risk (premium cost)

Traders also evaluate volume and open interest in the chain to determine liquidity and market sentiment. High activity around certain strike prices often signals where big investors are positioning themselves.

Reading an option chain is one of the most practical skills an options trader can develop. It turns raw data into actionable insights, enabling smarter decisions based on probabilities and market expectations.

Option Pricing: Cracking the Black Box

Behind every option price lies a matrix of calculations and variables that determine its market value. This process is often referred to as option pricing, and at its center is the famous Black-Scholes Model. While the formula itself is advanced, the components that influence price are straightforward once understood.

An option’s premium has two key parts:

- Intrinsic Value: The immediate value if exercised today (e.g., for a call, the stock price minus the strike price).

- Extrinsic Value: The remaining value based on time to expiration and volatility.

Several factors affect an option’s price:

- Underlying Price: The closer the asset’s price is to the strike price, the more valuable the option.

- Time to Expiration: The longer the time to expiration, the greater the extrinsic value.

- Implied Volatility: Higher expected movement increases the premium.

- Interest Rates and Dividends: These influence pricing slightly but matter more in longer-dated options.

While pricing models like Black-Scholes offer theoretical values, actual market prices can differ based on supply, demand, and sentiment. Mastering pricing involves combining theory with market observations to identify under- or overvalued opportunities.

The Option Greeks: The DNA of Option Behavior

If the value of an option were a living, breathing organism, the Greeks would be its genetic code. These risk measures offer insight into how an option’s price responds to various market forces. Rather than leaving outcomes to chance, understanding the Greeks equips traders with the predictive power to make informed decisions.

- Delta (Δ): Indicates how much the option price changes for a $1 move in the underlying asset. A delta of 0.50 means the option gains $0.50 for every $1 rise in the asset.

- Gamma (Γ): Measures how much Delta itself will change as the asset moves. High gamma means delta can shift rapidly, especially near-the-money.

- Theta (Θ): Represents time decay. As each day passes, an option loses value—even if the underlying doesn’t move. This is especially critical for short-term contracts.

- Vega (ν): Shows how sensitive the option is to changes in volatility. Higher Vega benefits long options during periods of volatility.

- Rho (ρ): Measures sensitivity to interest rate changes. While subtle in equity options, it becomes relevant in bonds and long-dated options.

Understanding the Greeks allows traders to construct strategies with surgical precision, balancing risk and return, fine-tuning exposure, and preparing for a variety of market environments.

Time, Volatility, and the Role of Expiration

In options trading, time is more than just a countdown; it is a fundamental force shaping every trade’s potential outcome. Unlike stocks, which can be held indefinitely, options come with a defined expiration date, creating a sense of urgency and strategic complexity unique to this market.

Time decay, measured by Theta, steadily erodes an option’s value as it approaches expiration. This loss of “time value” happens because the probability of a favorable price move diminishes with each passing day. For buyers, this means the underlying asset must move decisively enough to offset the premium lost to time decay. Conversely, sellers can profit from this inevitable erosion, collecting premiums as options lose value over time.

Expiration itself comes in various forms, each catering to different trading styles and strategic goals:

- 0DTE (Zero Days to Expiration) options expire on the same trading day and attract experienced scalpers who seek quick, high-risk/high-reward opportunities.

- Weekly options expire every Friday and are favored by traders looking for short-term speculation or to generate income with faster turnover.

- Monthly options typically expire on the third Friday of the month, providing more time for trades to develop, and are often the choice of institutional investors managing longer-term hedges.

Getting Started with Option Trading

Begin your journey with a strong foundation:

- Select a broker with robust options tools, including Greeks analysis and payoff diagrams.

- Use simulators or paper trading to gain hands-on experience without financial risk.

- Master one strategy at a time to build confidence and expertise.

- Stay informed with market news, implied volatility trends, and earnings calendars to anticipate changes effectively.

Education, practice, and discipline form the cornerstones of successful options trading.

Final Thoughts: The Strategic Power of Options

Option trading isn’t about guessing the market. It’s about structuring trades around probabilities, risk management, and strategic advantage. It offers tools that stock traders simply don’t have: defined risk, built-in leverage, and flexibility across every market condition.

Ready to elevate your options trading journey?

Explore OnePunch ALGO Academy, a dedicated trading community where practical strategy, real-world insights, and a structured approach come together to support traders at every stage. Whether you’re developing your first trade plan or refining complex techniques, the academy provides a focused space for growth and strategic alignment.

For ongoing learning and clarity on advanced concepts, visit the OnePunch ALGO YouTube Channel. It’s a curated resource for visual learners, featuring market breakdowns, strategy walkthroughs, and simplified tutorials designed to reinforce your trading knowledge.

These platforms serve as valuable resources intended to support informed decision-making, recognizing that consistent results are shaped by a trader’s discipline, strategy, and execution.

Take your next step with purpose through the right community, the right tools, and continuous learning.