The financial markets have undergone dramatic transformations over the past few decades. From straightforward stock investing to increasingly sophisticated financial instruments, traders and investors today have access to a universe of possibilities. Among these, option trading stands out as both a powerful and complex avenue, offering unique opportunities for growth, income, and risk management. Yet, a common question echoes among beginners and even experienced market participants alike:

Is option trading worth it?

The answer is nuanced. It’s not merely about whether options are worth trading, but when, how, and for whom. This article provides a comprehensive look under the hood of options trading, demystifying the mechanics, revealing its strategic versatility, and offering practical insights to help you determine if it aligns with your financial aspirations and temperament.

What Is Option Trading? Fundamentals That Form the Backbone

Fundamentally, option trading revolves around contracts called options, which are financial derivatives that grant the buyer the right (but not the obligation) to buy or sell an underlying asset at a specified price (the strike price) before or on a given date (the expiration date).

The Two Pillars: Calls and Puts

- Call Options: Provide the right to buy the underlying asset.

- Put Options: Provide the right to sell the underlying asset.

One option contract typically controls 100 shares of the underlying stock, introducing leverage by allowing a larger position to be controlled with a smaller capital outlay.

The Pricing Puzzle: How Are Options Valued?

Understanding option pricing is crucial for grasping the potential and risks associated with options. An option’s premium consists primarily of:

- Intrinsic Value: The immediate value if exercised, i.e., the difference between the underlying asset’s price and the strike price, when favorable.

- Time Value: Reflects potential future profitability; the longer until expiration, the higher the time value.

- Volatility: A key driver; higher volatility increases the likelihood that the option moves into profitability, thereby boosting its premium.

- Interest Rates and Dividends: Secondary factors influencing option value.

Why Options Have Captivated Traders: The Power of Flexibility and Leverage

Leverage: Multiplying Market Exposure

Options enable traders to gain greater market exposure with less capital. For example, purchasing a call option for $200 might control 100 shares of a $100 stock, equivalent to a $10,000 stock position, unlocking amplified gains if the stock price moves favorably.

Flexibility: Profit in Any Market Environment

Options are not just bets on rising markets. They offer strategies to capitalize on:

- Bullish trends: Buying calls or selling puts.

- Bearish trends: Buying puts or selling calls.

- Sideways markets: Strategies such as iron condors or selling covered calls can generate income even if the underlying price remains stable.

Defined Risk and Hedging

When buying options, the maximum loss is limited to the premium paid, a major attraction for risk-conscious traders. Meanwhile, options serve as invaluable hedging tools, allowing investors to protect their portfolios against downside risk without having to liquidate assets.

These benefits are often what draw traders into the world of options. But appreciating their value requires looking beyond theoretical advantages and into practical usage.

Risk Versus Reward: The Core Tradeoff in Option Trading

Options offer lucrative rewards but come paired with distinct risks and complexities.

Time Sensitivity: The Clock Is Ticking

Unlike stocks, which hold value until sold, options expire. As expiration approaches, the option loses time value daily, a phenomenon known as theta decay, which pressurizes buyers to correctly time market moves.

Volatility: The Double-Edged Sword

Market volatility, as measured by implied volatility, has a significant impact on option prices. While rising volatility can boost premiums, unexpected drops can erode value rapidly, posing risks especially for option sellers and buyers of volatility-sensitive strategies.

Complexity and Education

Options trading involves understanding the Greeks, metrics that quantify sensitivity to underlying price changes, volatility, and time:

- Delta: Rate of change of option price with respect to the underlying asset.

- Gamma: The rate of change of delta.

- Theta: Time decay rate.

- Vega: Sensitivity to volatility changes.

Mastering these is critical, as complex option strategies carry layered risks and potential for unexpected losses.

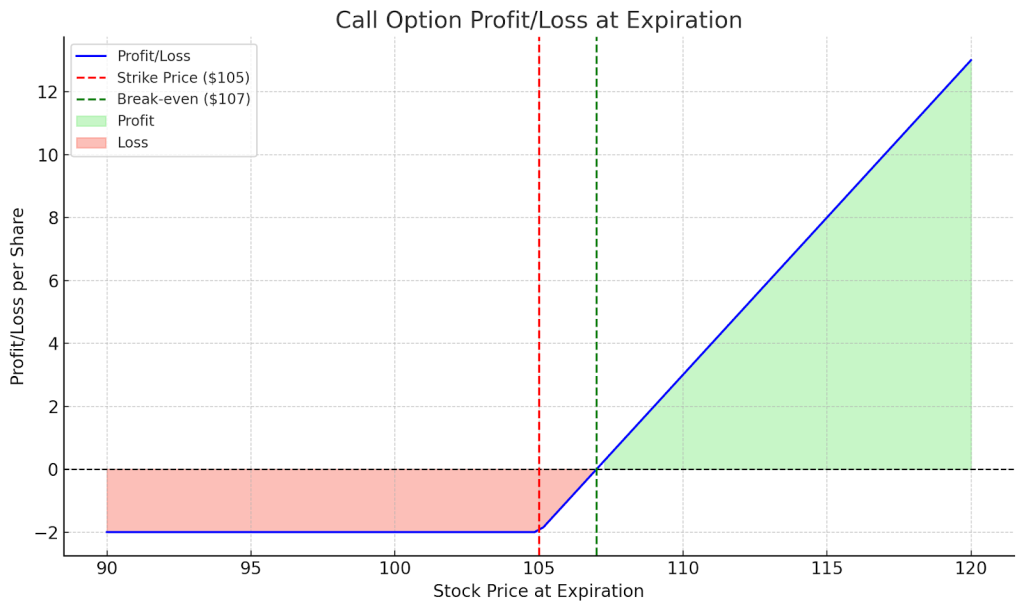

Practical Example: Buying a Call Option on Stock XYZ

Imagine the following scenario:

- Stock XYZ trades at $100

- You buy a call option with a strike price of $105, expiring in 30 days

- You pay a premium of $2 per share (or $200 per contract)

If XYZ rises to $110 before expiration:

- Intrinsic value = $110 – $105 = $5

- Profit = Intrinsic value – premium = $5 – $2 = $3 per share

- Total profit = $300 (excluding commissions/fees)

If XYZ stays below $105:

- The option expires worthless

- Loss = $2 premium per share ($200 total)

This example highlights the appeal of limited downside (premium paid) with leveraged upside potential.

Conceptual Graph: Call Option Buyer Payoff

The breakeven point here is the strike price plus the premium paid. Losses are capped at the premium, while profits rise as the stock price exceeds breakeven.

Real-World Execution: Options in Live Market Conditions

Theory is essential, but real insight comes from observing how options work in real-time. That’s where strategic intraday concepts, such as the Gap and Go strategy, become relevant. This approach aims to capture explosive price moves in the early part of the trading session by utilizing options contracts to leverage short-term volatility.

Traders often use 0DTE (Zero Days to Expiration) options for such strategies. These contracts expire on the same day, amplifying both risk and reward. When executed with precision, they can produce outsized returns in a matter of minutes. However, the volatility also requires discipline, technical expertise, and a well-defined exit strategy.

Watch a real-time breakdown of an options trade using the Gap and Go strategy:

While this video demonstrates a specific scenario, it illustrates the core strengths of options: targeted risk, amplified exposure, and strategic precision. It’s a glimpse into how professional traders think through execution, manage uncertainty, and align their risk-reward profiles with their setups.

Evaluating the Worth: Key Considerations

Whether option trading is worth it depends on several interwoven factors:

1. Trader’s Objectives

Are you seeking income, protection, or speculative gains? Options can meet each of these goals when used correctly. Income-seekers might sell covered calls; hedgers might buy protective puts; speculators might deploy vertical spreads or long calls.

2. Time Commitment

Mastering options is not passive. It requires education, market observation, and practice. Those willing to invest in learning tend to reap the greatest rewards.

3. Risk Tolerance

While defined risk is a feature of options, mismanagement can still result in significant losses, particularly in advanced strategies such as selling naked calls or short straddles.

4. Market Conditions

Volatility, interest rates, and macroeconomic factors heavily influence option pricing and viability. Some strategies excel in high-volatility environments; others perform better in range-bound markets.

Is Option Trading Worth It for Beginners?

Yes, If:

- There is a genuine commitment to learning about option mechanics and market behavior.

- You start with simple strategies, such as covered calls or protective puts.

- You understand and accept the risks, including potential loss of premium.

- You have a risk management plan and practice with simulated trading.

No, If:

- You expect quick riches without education.

- You’re uncomfortable with market volatility or rapid decision-making.

- You lack the time or discipline to master complex concepts.

Building a Strong Foundation: Educational Steps to Success

To maximize the value of option trading:

- Learn Option Terminology: Strike Price, Premium, Expiration, and Greeks.

- Understand the Options Chain: Read quotes, bid-ask spreads, and open interest.

- Start with Basic Trades: Long calls, long puts, covered calls.

- Practice Risk Management: Position sizing, stop losses, and diversification.

- Use Simulators: Paper trading platforms help build confidence without financial risk.

Beyond Basics: Advanced Strategies and Portfolio Integration

Experienced traders use options to:

- Construct spreads to limit risk and define reward.

- Create collars for protecting gains.

- Implement straddles and strangles to profit from volatility.

- Manage portfolio risk dynamically through option overlays.

These techniques underscore the options’ power as a multi-dimensional financial instrument.

Conclusion: The True Worth of Option Trading Lies in Approach and Commitment

The answer to “Is option trading worth it?” isn’t a simple yes or no. It lies in your perspective, preparation, and purpose. Options are not a guaranteed path to profit; they are a powerful toolkit designed to enhance opportunity, manage risk, and unlock new layers of strategy in trading.

When approached with discipline, education, and a clear strategy, options can elevate your financial playbook. They offer unparalleled flexibility, strategic depth, and the ability to profit in various market conditions, all while empowering you to hedge, speculate, or generate income.

However, this potential comes with complexity. Option trading is not for those seeking passive, “set-it-and-forget-it” investments. It’s for those who treat it as a craft, one that rewards consistency, research, and continued refinement.

Ultimately, the true value of option trading is not determined by the market; it’s defined by how well it aligns with your goals, mindset, and commitment to growth. If you’re ready to approach it as a craft, rather than a gamble, then yes, option trading can be absolutely worth it.

From Knowledge to Execution: Your Next Step

Success in option trading isn’t driven solely by what you know. It’s defined by how you apply that knowledge. Execution, structure, and continuous improvement are what transform insight into results.

That’s where OnePunch ALGO Academy comes in, a dedicated trading platform and community built to support traders at every level. Whether you’re crafting your first trade setup or optimizing multi-leg strategies, the academy offers an environment focused on growth, structure, and strategic alignment. Join the OnePunch ALGO Academy today to access proven frameworks, market-tested strategies, and a community that thrives on precision and performance.

To further deepen your understanding, the OnePunch ALGO YouTube channel serves as a curated learning resource. From market breakdowns to step-by-step strategy tutorials, it’s designed to make complex trading concepts more accessible through clear, visual learning. Subscribe to the OnePunch ALGO YouTube Channel to get hands-on with real-time analysis, simplified walkthroughs, and insights that bring clarity to your trading decisions.

Both the academy and the channel are built around one core principle: consistent results come from disciplined execution and informed decision-making. These tools are not about shortcuts; they’re about helping traders become more independent, precise, and confident in their approach.

Take your next step with purpose, by learning through structure, practicing with clarity, and growing within the right community.