In the dynamic world of financial markets, traders and investors constantly navigate between risk and reward, control and uncertainty, strategy and emotion. Among the many vehicles available to market participants, stock trading and option trading are two of the most popular yet fundamentally different paths toward achieving financial goals.

While both revolve around price movement, ownership, and timing, the way each generates profit and manages risk couldn’t be more distinct. Stocks represent ownership, a direct claim on a company’s future. Options represent rights, tools of leverage and probability that give traders strategic flexibility unmatched by any other asset class.

For many new traders, the debate between option trading vs. stock trading isn’t about which is better, it’s about which aligns better with their goals, temperament, and understanding of risk. To grasp that, one must first understand the core mechanics, advantages, and limitations that define each approach.

1. Understanding the Fundamentals

Stock Trading – Owning a Piece of the Company

When buying stocks, an investor becomes a shareholder, a partial owner of the company. This ownership grants voting rights and, in many cases, dividends.

The investor’s profit potential is directly tied to price appreciation (when the stock price increases) or income generation through dividends.

Example: If you buy 100 shares of Apple at $150 each, your total investment is $15,000. If Apple’s price rises to $180, your unrealized profit is $3,000. If it drops to $120, your loss is $3,000.

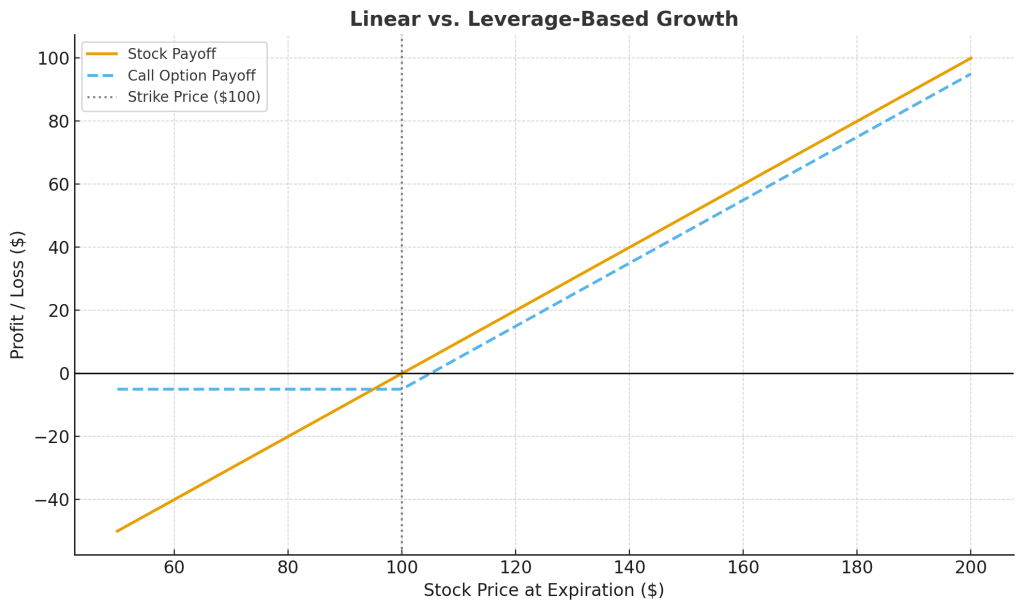

Stock trading is linear, your gains and losses move dollar-for-dollar with the stock price.

Key Characteristics:

- Direct ownership

- Unlimited upside potential

- Potential for dividends

- Full capital at risk (if the company’s value drops sharply)

Option Trading – Controlling the Same Stock for Less

Options are derivative instruments, meaning their value is derived from an underlying asset, usually a stock or index. An option contract gives the holder the right, but not the obligation, to buy or sell a stock at a predetermined price (the strike price) before a specific date (expiration date).

There are two main types:

- Call options – give the right to buy the stock

- Put options – give the right to sell the stock

Unlike stock trading, option trading allows for strategic flexibility, which you can profit from rising, falling, or even neutral markets, depending on how you structure the position.

Example: Instead of buying 100 shares of Apple for $15,000, you could buy a call option giving you the right to buy 100 shares at $150 for a premium of $3 per share ($300 total). If the stock rises to $180, your option is worth $30 per share, a 900% return on your $300 investment.

But if Apple stays below $150 at expiration, your option expires worthless, and you lose your $300 premium.

Visual Concept:

This graph illustrates the linear nature of stock gains versus the accelerated, leveraged growth potential of options, along with their defined downside.

2. Capital Requirements and Leverage

Stocks: Full Capital Exposure

When trading stocks, the capital requirement equals the share price multiplied by the number of shares. If you buy 500 shares of a $100 stock, you must commit $50,000. Even with margin trading, regulations typically require 50% of the trade value upfront.

Options: Fractional Exposure with Built-In Leverage

Options allow control over 100 shares of stock per contract, often for a fraction of the stock’s cost. This built-in leverage magnifies both potential gains and potential losses (up to the premium paid for buyers).

Example:

| Asset Type | Cost per Unit | Quantity Controlled | Total Exposure | Initial Capital |

| Stock | $100 | 100 shares | $10,000 | $10,000 |

| Call Option | $2 (per share) | 100 shares | $10,000 | $200 |

This table shows that with $200, an option trader can control the same exposure as a $10,000 stock position, emphasizing capital efficiency but also risk sensitivity.

3. Risk and Reward: Defining the Boundaries

Stock Trading: Unlimited Downside, Simple Structure

Stockholders face unlimited downside until the stock’s price hits zero. There’s no expiration, but protection requires stop-loss orders or hedging through options.

Option Trading: Defined Risk and Strategic Flexibility

Options offer asymmetric risk profiles, where the maximum loss is predefined (premium paid) but the potential reward can be substantial.

For example:

- A long call has limited risk (premium) and unlimited reward.

- A long put profits from declines with limited cost.

- A spread defines both risk and reward ranges through offsetting contracts.

4. Time and Volatility: The Hidden Dimensions

Time Factor (Theta Decay)

Unlike stocks, options lose value over time, a concept called time decay or Theta. Each passing day reduces the option’s extrinsic (time) value, particularly as expiration nears.

Volatility (Vega)

Volatility measures how much a stock’s price is expected to move. Increased volatility raises option premiums (more uncertainty = higher potential). Traders can use this to their advantage through volatility-based strategies such as straddles or iron condors.

5. Ownership vs. Control

Stockholders: Ownership Rights

Stockholders own part of the company, gain dividends, and have voting rights. Their objective is often long-term growth and income generation.

Option Traders: Market Control without Ownership

Option traders don’t own the company, they control exposure. They use contracts to express opinions on price direction, volatility, and timing without committing large capital.

This difference is philosophical:

- Stock trading = investing in a business.

- Option trading = speculating on probabilities and outcomes.

6. Strategy Depth: Simplicity vs. Customization

Stock Trading Strategies

Stock strategies are generally straightforward:

- Buy and hold

- Dollar-cost averaging

- Dividend reinvestment

- Short selling

They’re simple but lack the risk modulation that options provide.

Option Trading Strategies

Options are infinitely customizable, from basic single-leg trades (long calls/puts) to complex multi-leg setups like spreads and butterflies. Each structure targets a specific market condition: bullish, bearish, neutral, or volatility-driven.

Example Breakdown:

- Bullish: Long Call, Bull Call Spread

- Bearish: Long Put, Bear Put Spread

- Neutral: Iron Condor, Calendar Spread

- Volatility Plays: Straddle, Strangle

Options let traders act like architects of risk, shaping probability, time, and price movement into controlled outcomes.

7. Taxation, Expiration, and Execution

Stocks

- No expiration dates.

- Typically qualify for long-term capital gains if held over a year.

- Execution is simple, buy and sell shares.

Options

- Have fixed expiration dates (weekly, monthly, quarterly).

- Taxed differently depending on holding period and contract type.

- Require understanding of assignment risk, rollovers, and closing positions before expiry.

This makes option trading more tactical and time-sensitive than stock trading.

8. Which Is Better? Aligning Trading Style and Mindset

The decision between stock trading and option trading is not about superiority, it’s about alignment.

| Criteria | Stock Trading | Option Trading |

| Capital Requirement | High | Low |

| Risk | Unlimited downside | Defined (premium) |

| Complexity | Low | High |

| Time Sensitivity | None | Yes |

| Volatility Impact | Moderate | High |

| Strategy Flexibility | Limited | Extensive |

| Ownership | Yes | No |

| Reward Potential | Linear | Asymmetric |

Stock trading suits investors seeking stability and long-term growth.

Option trading attracts strategists who thrive on precision, control, and mathematical advantage.

Conclusion: Two Roads, One Destination

In the grand landscape of financial markets, both option trading and stock trading lead to the same destination, financial growth, but through distinctly different paths.

Stocks provide ownership, simplicity, and steady accumulation. Options offer flexibility, leverage, and multidimensional strategy design. The key lies not in choosing one over the other, but in understanding how each complements your goals.

Traders who master both gain a profound edge, combining ownership from stocks with the precision of options to create portfolios that adapt, hedge, and grow through all market conditions.

Next Step: From Knowledge to Application

Success in trading isn’t built on predictions, it’s built on precision, structure, and disciplined execution. That’s where OnePunch ALGO Academy stands out.

As a dedicated trading platform and community, it bridges the gap between theory and real-world application, helping traders transform insights into actionable strategies. The Academy provides structured systems, live market perspectives, and collaborative environments where traders can refine their approach and grow with purpose. It’s built for those who treat option trading as a craft, not a gamble, providing the structure and environment needed to grow strategically.

To enhance this ecosystem, the OnePunch ALGO YouTube Channel complements the academy’s philosophy through practical, real-market sessions, where concepts are applied through live examples and detailed analysis. This demonstrates how structured methods translate into confident execution. Watch the video below to see these strategies come to life and gain a deeper understanding of real-time option setups.

Together, these two resources form a complete ecosystem for traders who aspire to evolve from learning to mastery. While tools and communities can guide the path, it’s the trader’s discipline, consistency, and insight that ultimately define success. OnePunch ALGO empowers that journey, helping traders turn strategy into skill, and knowledge into lasting results.