In the dynamic world of financial markets, few tools offer the flexibility, power, and strategic potential of modern trading instruments. As the global economy becomes more digitized and interconnected, investors are constantly seeking innovative ways to manage risk, enhance portfolio returns, and navigate volatility with precision. Trading, in its many forms, has evolved into a key avenue for building wealth and achieving financial independence.

At its core, trading involves the buying and selling of financial assets in a marketplace, including stocks, commodities, currencies, and derivatives. Traditional investing often leans toward long-term holding strategies, aiming for gradual growth, such as purchasing shares in a blue-chip company or making regular contributions to an index fund. Trading, on the other hand, tends to be more dynamic and involves making calculated decisions based on market trends, price movements, and macroeconomic indicators.

With the rise of technology and widespread access to brokerage platforms, more individuals are entering the trading space, exploring not only stocks and ETFs but also more specialized financial instruments that offer greater leverage and precision. As investors gain experience and seek to refine their strategies, many eventually venture into the world of derivatives, a category that includes futures, forwards, and notably, options.

Options trading has emerged as one of the most sophisticated and strategic areas within the trading field. It offers distinct advantages in terms of flexibility, hedging capabilities, and profit potential with limited capital.

But what exactly is options trading? Why does it matter so much in today’s market landscape? And how can both novice investors and seasoned professionals use it to their advantage? This guide aims to unravel the mystery, decode the jargon, and break down the concepts, while keeping the passion for financial growth at its heart.

Whether you are just starting out or already exploring derivatives, this article provides a comprehensive framework to help readers understand the mechanics, benefits, and strategic value of trading options. Prepare to gain deep insights, clear visual explanations, real-world scenarios, and actionable guidance that connects theoretical concepts directly to effective trading practices.

Exploring the Essence of an Option

At its core, an option is a contract. However, it’s not just any contract; it offers leverage, flexibility, and a distinct set of opportunities and responsibilities. Options grant the right, not the obligation, to buy or sell an underlying asset at a predetermined price before a specified date. This conditional nature allows traders to speculate on price movements without the need to own the actual asset.

There are two main types:

- A Call Option allows the holder to buy the asset at the strike price.

- A Put Option allows the holder to sell the asset at the strike price.

Consider the following example: If stock XYZ trades at $100 and you buy a call option with a strike price of $105, expiring in 30 days, you’re betting that the stock will rise above $105. If it does, say to $120, you can buy it at $105 and potentially resell it at a profit, minus the premium you initially paid for the option. This shows how options can create profit opportunities even with a limited initial investment.

The Vocabulary of Options: Knowing the Lingo

To truly grasp the mechanics of options, one must understand its language. Options trading comes with a set of terms that might seem complex at first, but are crucial to long-term success. By demystifying this terminology, traders can confidently navigate the markets.

- Strike Price: The agreed-upon price to buy or sell the underlying asset. This price determines whether the option is profitable or not.

- Premium: The price paid to acquire the option contract. It’s essentially the cost of participating in the potential upside (or downside).

- Expiration Date: The expiration date is the deadline by which the option must be exercised or traded. Options come with varying timeframes. Monthly options typically expire on the third Friday of the month, weekly options (or “weeklys”) expire every Friday, and 0DTE (Zero Days To Expiration) options expire at the end of the trading day. The time remaining until expiration has a significant impact on an option’s value and risk.

- Underlying Asset: The financial instrument (stocks, ETFs, indexes) tied to the option. The performance of this asset drives the value of the option.

- In the Money (ITM): An option that would lead to a profit if exercised today. It already has intrinsic value.

- Out of the Money (OTM): An option that would result in a loss if exercised. It only holds time and volatility value.

- At the Money (ATM): When the asset’s market price is equal to the option’s strike price. It’s the point of transition, where profit potential starts to emerge.

Understanding these terms lays the groundwork for comprehending more complex strategies and evaluating real-time trading decisions.

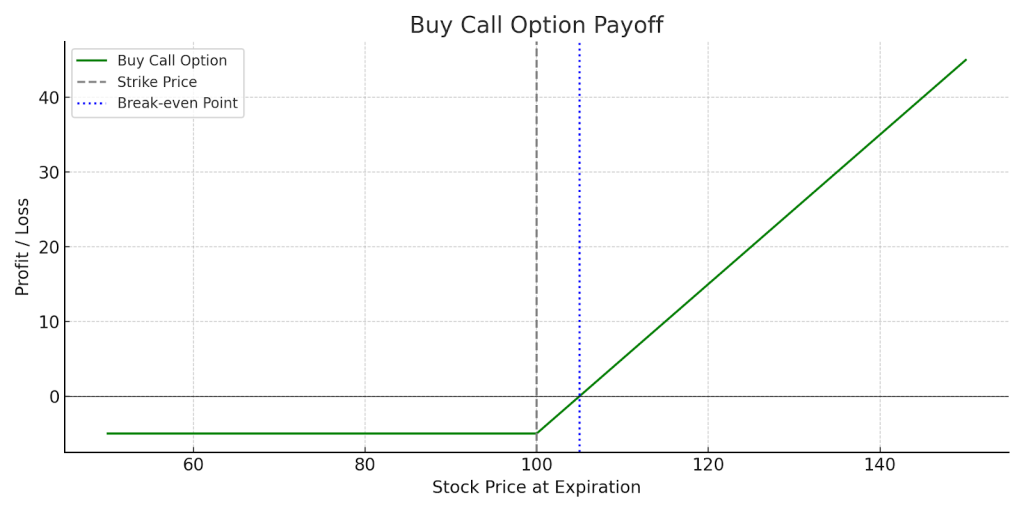

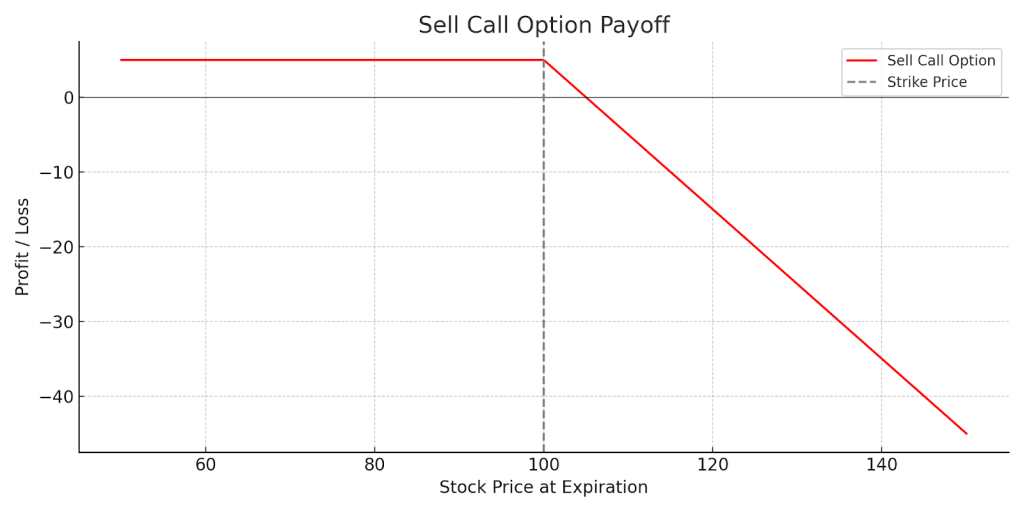

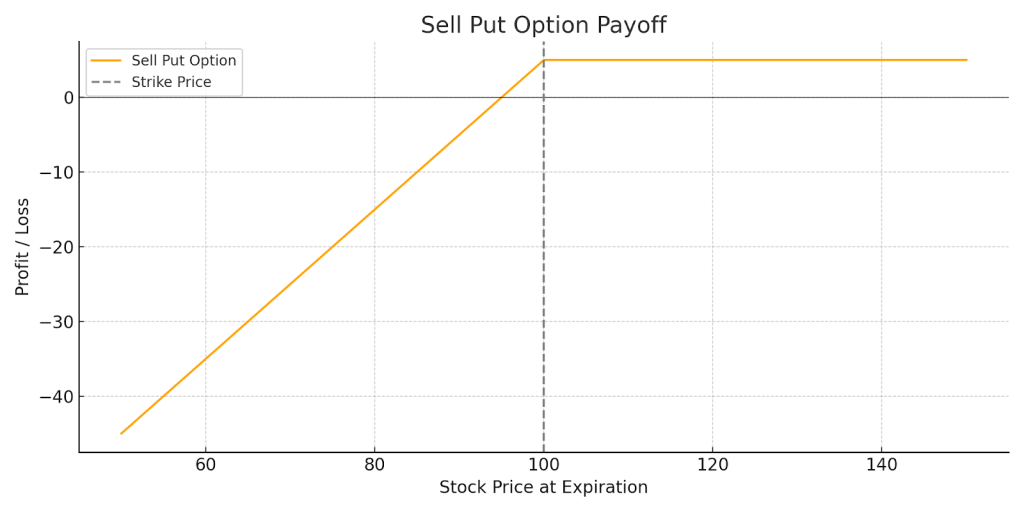

Visualizing Profit and Loss in Options Trading

Understanding the profit potential and risk associated with options is best done through visual tools. Profit/loss diagrams help illustrate what a trader stands to gain or lose with various strategies. These visuals make the payoff structure easy to interpret and provide insight into the asymmetric risk-reward nature of options.

Buying a Call Option (Bullish Strategy):

- A trader buys a call option when expecting the underlying asset’s price to rise above the strike price. This is a straightforward bullish bet.

- If the stock price ends up below the strike price at expiration, the call option expires worthless, and the trader loses the premium paid.

- However, if the stock price moves above the strike price, the trader can buy the stock at a lower price and either sell it at market value or let the profit accumulate through the option’s price increase.

- The loss is capped at the premium paid, while the profit potential is unlimited.

Selling a Call Option (Bearish or Neutral Strategy):

- Here, the trader is selling a call with the expectation that the asset will remain below the strike price.

- The seller collects a premium upfront. If the stock remains below the strike price, the option expires worthless, and the premium is kept as profit.

- However, if the stock rises above the strike price, the seller may be forced to deliver the asset at the strike price, incurring losses if they don’t own the underlying (known as a naked call).

- Thus, the maximum gain is limited to the premium, while the loss is theoretically unlimited.

Buying a Put Option (Bearish Strategy):

- A put option buyer expects the price of the asset to fall below the strike price.

- This strategy profits when the underlying asset drops below the strike price, giving the holder the right to sell it at a higher predetermined price.

- The most a trader can lose is the premium paid. This makes it a cost-effective hedge during bearish markets.

- The profit increases as the stock price falls, potentially to zero.

Selling a Put Option (Bullish or Neutral Strategy):

- A trader sells a put when they expect the asset’s price to remain the same or rise.

- The seller receives a premium and bets that the option expires worthless.

- If the stock drops below the strike price, the seller may be forced to buy the asset at a higher price, resulting in a loss.

- Therefore, the maximum gain is the premium received, and the risk is substantial if the asset falls significantly.

These diagrams play a crucial role in illustrating the unique payoff structures of different option strategies. By studying these visual aids, traders, whether beginners or experienced, can clearly see how price movements in the underlying asset impact potential gains and losses. This helps in assessing whether a particular strategy fits their market expectations and risk tolerance. Additionally, these graphs highlight key concepts, including break-even points, maximum possible profits, and potential losses, enabling traders to make more informed and confident decisions.

The Greeks: Navigating Option Price Sensitivity

Options pricing isn’t random; it’s influenced by variables known as the Greeks, each measuring a specific sensitivity. Understanding these metrics is like having a dashboard of indicators for your options strategy.

- Delta (Δ): Measures the rate of change in the option’s price relative to a $1 change in the underlying asset. A delta of 0.6 means the option will gain $0.60 for every $1 move in the stock.

- Gamma (Γ): Measures how much Delta changes with the underlying asset’s price. Gamma is crucial for understanding how quickly an option becomes more or less sensitive to changes in its underlying asset.

- Theta (Θ): Indicates time decay, how much value an option loses each day. Options are wasting assets, and theta shows how much the clock works against you.

- Vega (ν): Shows sensitivity to changes in implied volatility. Higher volatility increases option premiums, benefiting long-option holders.

- Rho (ρ): Reflects how option prices react to interest rate changes. While less important for short-term traders, it’s relevant in bond and rate-sensitive environments.

By monitoring the Greeks, traders can fine-tune their strategies, anticipate how market conditions affect pricing, and make smarter decisions.

Strategic Playbook: Building Options Strategies

Options shine brightest when crafted into smart, well-thought-out strategies. Traders can combine calls, puts, or both to align with specific market outlooks. Let’s explore how different strategies can be used based on goals and market scenarios.

Covered Calls are perfect for those holding a stock but wanting to generate additional income by selling a call option. If the stock remains below the strike price, you retain the premium and the stock, thereby enhancing returns without incurring additional risk.

Protective Puts serve as an insurance policy; buying a put option on a stock already owned can prevent major losses in downturns. It’s like buying homeowner’s insurance for your portfolio.

Vertical Spreads, such as bull call or bear put spreads, involve buying and selling options at different strike prices, thereby limiting both risk and reward. This is useful for traders who want to benefit from directional moves without the full risk of buying naked options.

Straddles and Strangles are designed for volatile markets, where the direction of the move is uncertain, but a large swing is anticipated. They’re ideal before earnings or major announcements.

Iron Condors are best for neutral markets, where a trader profits if the underlying asset stays within a set range. It’s a favorite for advanced traders who expect low volatility.

Each strategy serves a purpose, and understanding when and how to use them makes a trader more adaptable and successful.

Why Traders Choose Options: The Advantages

There are several compelling reasons investors turn to options:

- Leverage allows control of more assets with less capital. One option contract typically represents 100 shares, offering huge exposure with limited funds.

- Versatility empowers traders to design strategies for bullish, bearish, or sideways markets. You’re not tied to one outlook.

- Hedging offers protection against market downturns. Investors can safeguard portfolios with cost-effective insurance.

- Income Generation is possible through premium collection (via selling options). For example, selling covered calls can create a consistent cash flow.

Options aren’t just speculative; they’re a smart financial toolkit for intelligent investing. This flexibility makes them a favorite among traders seeking precise control over their portfolios.

Navigating the Pitfalls: Risks of Options Trading

While powerful, options trading isn’t without its risks:

- Time Decay can erode the option’s value rapidly as expiration nears. This is especially true for OTM options.

- Volatility can move against you quickly, especially during earnings announcements or major market events. Sudden spikes or drops can disrupt planned strategies.

- Complexity makes it easy for unprepared traders to miscalculate risk. Options require careful analysis and discipline.

- Liquidity Issues may arise in low-volume options, causing difficulty in entering or exiting positions. This can result in slippage or forced losses.

A disciplined approach, risk-management protocols, and continuous education are essential to long-term success. Never enter a trade without knowing your maximum risk and exit plan.

Getting Started: A Roadmap for New Traders

Entering the options market starts with preparation:

- Educate thoroughly through books, webinars, and virtual trading. Knowledge is your first line of defense.

- Select a broker that provides comprehensive tools for options analysis. Good platforms offer visual tools, analytics, and alerts.

- Start with basic trades such as covered calls or protective puts. These strategies allow learning with limited exposure.

- Use demo accounts to gain experience before committing real capital. Practice trading helps understand market behavior without financial pressure.

Understanding your own risk tolerance and financial goals is crucial before making your first trade. The right mindset will guide your success.

The Real-World Impact of Options Trading

Options aren’t just for Wall Street professionals; they’re used globally by corporations and investors for practical, real-world reasons:

- Corporations hedge against commodity price fluctuations, securing input costs and stabilizing cash flow.

- Investors use puts to insure large portfolios, protecting against sharp declines.

- Speculators capitalize on news, earnings, or technical breakouts, creating high-reward opportunities.

Options trading has become an integral part of modern financial strategy, providing traders with control and creativity unmatched by traditional investing. It integrates seamlessly into professional and retail financial planning.

Conclusion: Unlocking the Power of Options

Options trading is much more than a speculative pursuit. It is a refined, strategic, and intellectually engaging method of participating in the financial markets. While the learning curve may be steep, the rewards, for those who invest time in understanding the intricacies, can be substantial.

From risk management to profit maximization, from income strategies to portfolio protection, options offer a gateway to financial mastery. In a market defined by uncertainty, they provide structure, leverage, and confidence.

Approach options not as a gamble, but as a professional’s toolset. Begin with education, practice with intention, and refine your strategies as your understanding deepens. Learn to read the markets, analyze the Greeks, and interpret volatility. With time, you’ll build both intuition and expertise.

As Warren Buffett wisely stated, “Risk comes from not knowing what you’re doing.” In the world of options, knowledge isn’t just power – it’s protection.

And if you’re ready to apply what you’ve learned with structure and support, connect with OnePunch ALGO Academy, a trading community built for those serious about refining their edge. Designed for traders at all levels, the academy provides a space for growth through shared strategies, real-time insights, and practical experience in today’s markets.

Whether you’re just starting or scaling advanced techniques, OnePunch ALGO Academy provides the tools, environment, and guidance to evolve with purpose.

Looking to reinforce your learning visually? Explore the OnePunch ALGO YouTube channel, where educational content breaks down complex ideas into clear, actionable lessons. From live trade examples to tutorials on strategy, it’s a resource crafted to support your learning journey, whenever and wherever you need it.

While success in trading is always shaped by individual effort, having access to quality resources, structured guidance, and an engaged community can provide meaningful support on that journey.

Start exploring, stay curious, and take your next step with intention. Your trading evolution begins with the tools you choose to sharpen.